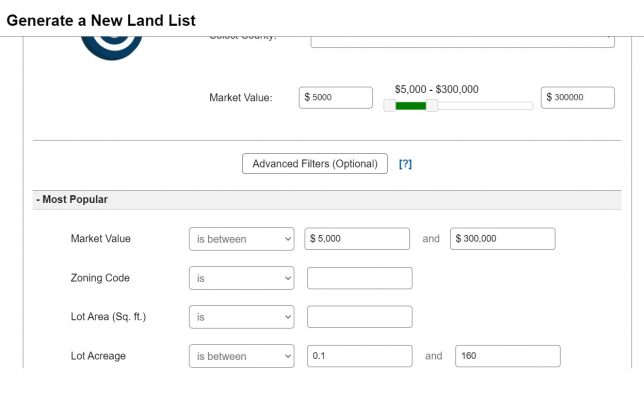

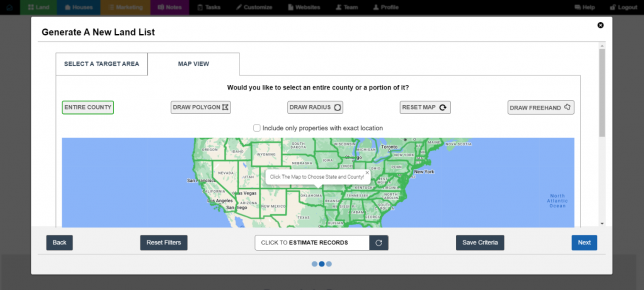

Data Service Pre-Selected (Default) Filters

By default, when you use our Data Service to import land records into your system, we pre-select a few filters for you based on our standard Land Profit Generator recommendations. These pre-selected filters are: Advanced Filters: Most Popular: Market Value: Between $5,000 and $300,000 Lot Acreage: Between 0.1 and 160 Acres Land Use Codes: 7023 …