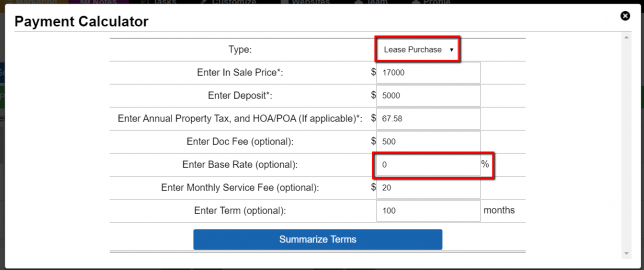

Sell Wizard

With the introduction of the new wizards coming to the Investment Dominator we wanted to provide a step-by-step solution to help with Selling. Let’s break down how this will impact how you use the Investment Dominator. You are given the choice to choose if you want to Generate A Listing or Process New Prospects looking for …