Payment Calculator: How to Calculate Loan/ Lease Terms on the Fly (for Land Investing)

When it comes to marketing land, many investors choose to offer two price points: one for a cash purchase and one for a purchase that includes terms.

Let’s talk about calculating the terms of a sale with seller financing.

Unless you have the Rainman-esque ability to calculate large numbers in your head on the fly, chances are that you will need a little help determining the monthly payments – especially if interest and amortization involved.

The Investment Dominator (with its built-in payment calculator) is here to save the day!

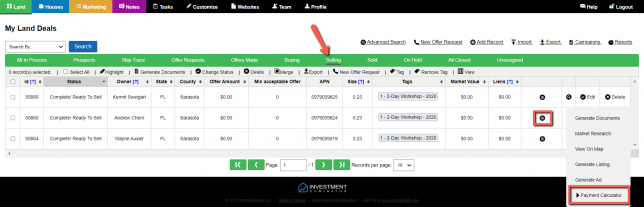

After logging into your Investment Dominator CRM system and clicking on ‘Land‘ tab, make sure that the property you want to calculate terms for is in the “Complete/Ready to Sell” status.

Then, hover over the ‘Options‘ icon on the right-hand side of the record and click the option that says “Payment Calculator“.

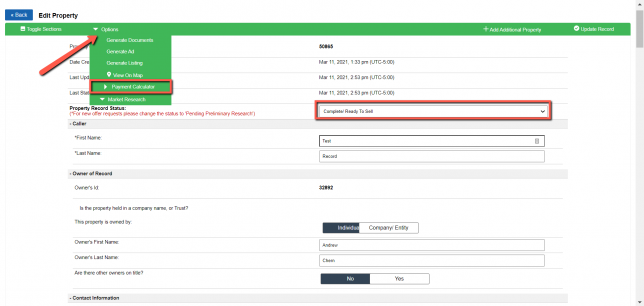

NOTE: You can also get to the Payment Calculator under the property record (or Edit screen of the record) by clicking on ‘Options> Payment Calculator‘ from the top menu of the record:

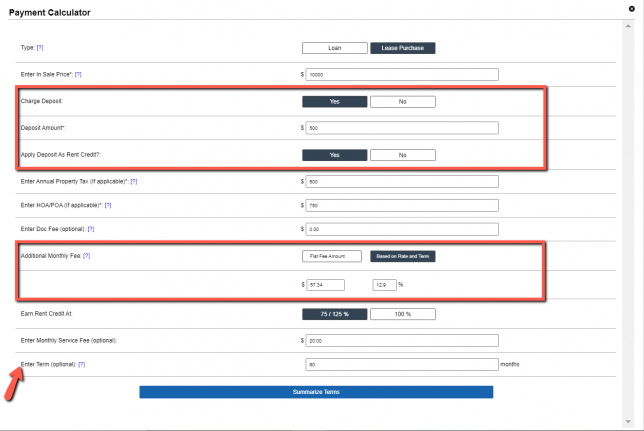

A new window will open that will allow you to enter in information about how you would like to structure the term sale.

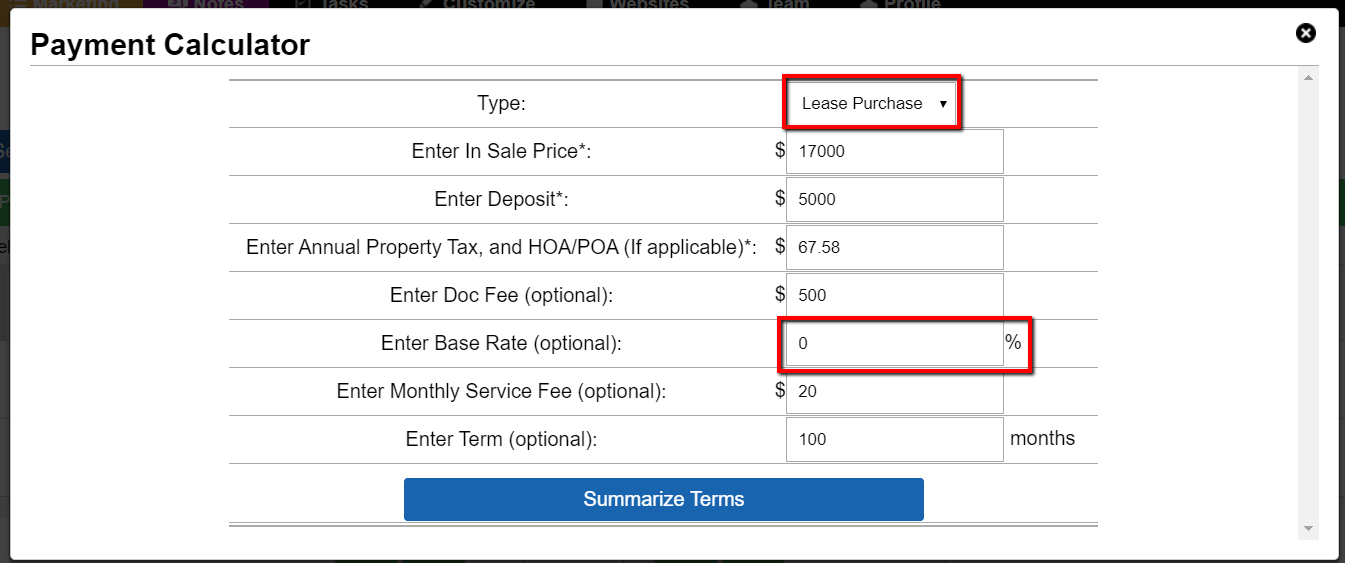

NOTE: The ‘Sale Price‘, ‘Down Payment/ Deposit‘, and ‘Annual Property Tax, and HOA/POA‘ fields are REQUIRED to have a value even if that value is 0.

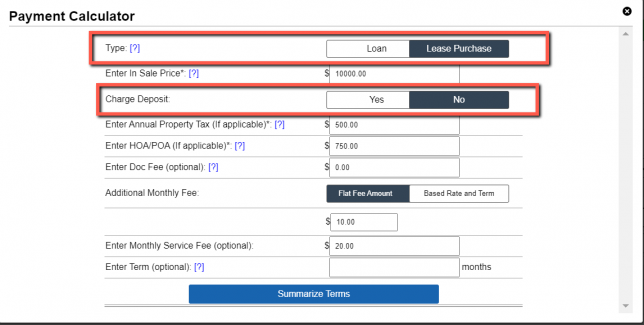

At the top of the screen, you will see a ‘Type‘ option which allows you to calculate either loan terms or lease-purchase terms.

NOTE: Regarding the ‘Deposit‘ for a ‘Lease Purchase’ this is not the same as a down payment for a loan. For a loan when you submit a down payment it will be applied to the Sales Price total which reflects when you ‘Summarize Terms’. While A ‘Lease Purchase’ will apply the optional deposit amount as Rent Credit at the time of signing, or be treated as an additional amount that is not factored into any aspect of the lease purchase.

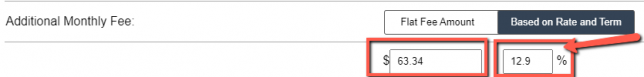

If you select ‘Lease Purchase’ some things you will notice by default is ‘Charge Deposit’ is set to No and ‘Additional Monthly Fee’ is set to ‘Flat Fee Amount’ set to $0. However, if you were to select ‘Based Rate and Terms’ you are able to charge an ‘Additional Monthly Fee’ which can be automatically calculated by entering a percentage or just a fixed number.

IMPORTANT NOTE: Lease Purchase Notes do not factor in an interest rate; however, the ‘Additional Monthly Fee’ allows you to calculate a Rent Payment that is higher than the amount earned each month as Rent Credit. If you enter in 0 under the ‘Additional Monthly Fee’ field then the monthly Rent Payment will equal the Rent Credit amount.

If you enter in a % value, the amount that is calculated will match the equivalent amount that you would charge for a loan based on an Interest Rate that matches the % value that you enter:

Under ‘Enter Term (optional)’ you can input how many months you want this for. If you leave this field blank the system will automatically assign a term value and will display it on the summary page.

NOTE: The “Taxes and HOA/POA” field refers to the total ANNUAL dues for property taxes and HOA/POA fees for that property. The system will prorate these by month and add them to the total monthly payment due to the buyer.

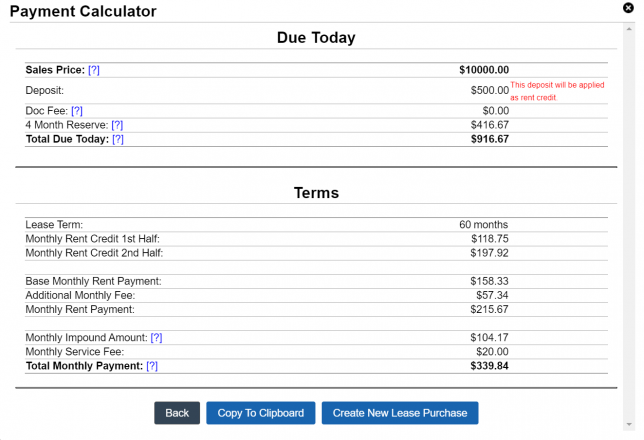

After you put in the information (both required and optional), click on the button that says “Summarize Terms” and the system summarizes the details of the term.

Click the ‘Back‘ button to go back to the previous screen to make adjustments.

Click the ‘Copy To Clipboard‘ button to copy the contents of the Summary Page to your computer’s clipboard.

Click the ‘Create New Loan‘ or ‘Create New Lease Purchase’ button to set up the note.